And today, I'm glad to announce that I've bought another book from the Rich Dad series. Prices doesn't matter if this book is able to teach me something more than what the price of the book is worth. To me, the $17 that i paid for this book had already made it's return. It's like buying and taking a vitamin pill to enhance your health. In this case, it's my financial health that I'm referring to.

Without beating around the bush, I'll move directly to what i thought about the Financial market after Friday's situation in the US.

The Dow Jones closed below the 10000 mark for the first time after showing initial signs of recovery for the past 5 trading sessions. And this sell-down sentiment is mainly due to the less than expected results being released on the labor growth section on Friday. Of cause, since I'm been blessed with the Macroeconomics skills that i had picked up from studying in UOL, I shall briefly share with you some fundamentals of Macroeconomics.

The Dow Jones closed below the 10000 mark for the first time after showing initial signs of recovery for the past 5 trading sessions. And this sell-down sentiment is mainly due to the less than expected results being released on the labor growth section on Friday. Of cause, since I'm been blessed with the Macroeconomics skills that i had picked up from studying in UOL, I shall briefly share with you some fundamentals of Macroeconomics.The fundamentals of Macroeconomic is derives as gross domestic product (GDP) or we call it output can be derived from various major components.

Equation: GDP = C + I + G + X -M where:

1) C refers to Consumer spending

2) I refers to Private investments

3) G refers to Government spending

4) X refers to Export

5) M refers to Import

Different economies have different weightage in sustaining the GDP growth. US economy is being sustained by 70% coming from the consumer spending (C) whereas Singapore's economy is dependent highly on the Exports (X) section.

What happens during a recession is that consumer spending (C) and Private investment (I) will fall due to lower confidence and people being cautious on their spending and savings behavior. We also know that Exports and Import demands would fall due to the very same reason as what happens to the private sectors.

Thus, In times of recession, the Government spending (G) is the only component that is keeping the GDP in positive figures as the economy moves forward. This explains why in times of recession, the economy growth rate is always being slowed down or at times, even deteriorate. We know that the economies have to sustain the same growth rate despite the withdrawal of the contributions from other major components. In short, Government spending has to increase in order to save the economy or we shall face higher unemployment rate as an consequence of recession.

If you need an example of where to government spend, Singapore's example is that the HDB lift upgrading programme had been brought forward to boost government spending as well as what we are seeing in some of the MRT station which is the implementation of the 'barrier' on the platform. In Singapore, it is known as Government stimulus package. All these expenses were budgeted annually by the government but due the the recession in 2007, the government had to bring forward what was being planned to be implemented slowly in the latter years.

Applying the concept to the current situation, The current Budget deficit crisis in Greece, Spain, Ireland, Portugal and many more economies are caused due to the increment of their government spending back in 2007, and the recent article published in the news that the US faced a debt of USD$18 trillion is the record highest in their history. Basically, we can comment that the economies had been over-heated just like a car engine. And the reason why analyst are monitoring this situation is because the US are signaling to the world that they couldn't save the global economy once again.

And so far, there is no clear way out of how the global economies are going to withdraw their government stimulus package in times like this and still sustain the confidence of the consumers and investors. I had said this previously and i shall say it again:

"We are facing many more signs that could lead us back into a double dip recession if the withdrawal of the government stimulus package isn't done properly."

As for fundamentals, i can write 10 post on it but i guess i should stop here. I'm sure you guys doesn't want to hear how this crisis started but rather, how you could benefit or make money during this crisis. So, here are my views.

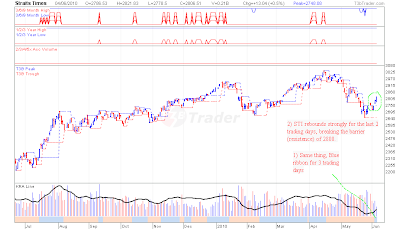

The STI would probably open lower come monday after what had happened on Friday. Since Friday's trading day was a positive gain, it would make matter worse. I would say that it is actually a pity as the signs of recovery actually appeared as denoted by the blue ribbon at the bottom of the charts.

.png) Furthermore, The STI had recently broke the peak of 2800 which just few days ago, was giving investors and traders the confidence that the recovery is strong. But the impact of the news released on friday, I would say, is going to have a major impact on the global recovery. As such, here are my insights and analysis.

Furthermore, The STI had recently broke the peak of 2800 which just few days ago, was giving investors and traders the confidence that the recovery is strong. But the impact of the news released on friday, I would say, is going to have a major impact on the global recovery. As such, here are my insights and analysis..png) The SGX stock represents the image of what the Straits Time Index (STI) and if you're fast, you might get a piece of the pie when the market sell-down come Monday's opening. This is also subject to individual's risk appetite. My take is, if you're going to short the SGX counter, monitor the news closely as to whether if there might be a twist in the current 'story' enactment.

The SGX stock represents the image of what the Straits Time Index (STI) and if you're fast, you might get a piece of the pie when the market sell-down come Monday's opening. This is also subject to individual's risk appetite. My take is, if you're going to short the SGX counter, monitor the news closely as to whether if there might be a twist in the current 'story' enactment.I welcome feedback as to whether you would like me to post more economics fundamentals here since i understand that i could get boring at times.

Lastly, I would like to end this post with a sentence i picked up from the Rich Dad, Poor Dad book:

"Winners ain't afraid of losing and people who are afraid of losing can't be winners."

You can play it safe by keeping your money at the bank or you can make a go for the investment opportunity. It's your choice. You choose.

No comments:

Post a Comment