I presume that Chopard is also a t3B member from the way you asked question in the email. I shall not disclose any information from his email here for confidentiality reasons.

What made me happy was that i received an email from a fellow trader asking me for advises and i totally do not know where you've gotten my email address from other than from my blog.

But then, what made me disappointed was that you wrote in a manner that you might have some doubts over whether the t3b system actually MAKES you money.

I understand that i may not be in the best position to give you advises especially if i am not already in the level of our mentor, Darren and Derick. But from the little words i read from the email, I could sense that you, my friend had derailed from the plan.

I use the word 'plan' because i believed that Investing is a plan, but not a product or procedure. what we should be wary of is not to develop emotions with the products or procedure. Here's an example to explain what i mean.

Keane lee once taught us that we should not develop 'feelings' with our stocks. But everybody laughed at the level of 'childishness'. But i believe what he actually means is to NOT be attached to only stocks.

An Investment is a plan. A plan that takes you from point A to point B. I call it a plan to take me from what i am now, to what i seek which is financial freedom. I'm sure everybody aims to be financially free rather than to buy and trade stocks for the sake of the trill.

Investing can come in different types of vehicle. Some examples are, Real-estate, Options trading just to name a few. And what I and Terence as well as all the t3b members had chosen was the vehicle of stocks investment.

Whichever method we use in choosing what stocks we buy is also known as the procedures of the 'Plan'. We can use t3b's methods, or we can use others' method like P/E ratio analysis. There's many methods that each individual can choose from. But always remember this important lesson.

We do not fall in love with the vehicle (types of investment), Product (stocks) or the Procedure (trading methods). A example of somebody whom does the above description would be someone who only buys stocks that he like.

For the greater good in achieving your financial freedom, we have to stick to the 'Plan'. Regardless of which vehicle of investment, we will invest as long as you have done your risk-reward calculations and deem it a 'low' risk investment opportunity.

Moving on to my views on what happened to the US market last week.

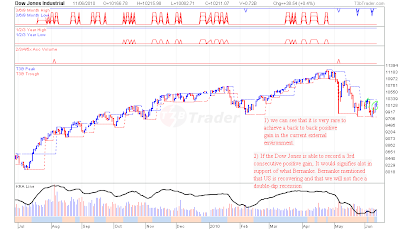

.png) The DJI closed with a consecutive positive gain which i felt personally that it could be the results of news trading. There were very contradicting analysis on the market. US federal Chairman, Bernanke, claims that the US economy is recovering and we are unlikely to see a double-dip recession.

The DJI closed with a consecutive positive gain which i felt personally that it could be the results of news trading. There were very contradicting analysis on the market. US federal Chairman, Bernanke, claims that the US economy is recovering and we are unlikely to see a double-dip recession. Another report soon came up with the analyst claiming that Bernanke is Wrong! He claims that the Bear is already here as many people are still believing that the market are still in the 'correction' stage. There is a very popular article that I've read claiming that:

Back in 1930s, people then doesn't know that it was the GREAT Depression then! They thought that it was also 'market correction' not the index fell so low and it did not recover until half a century later!

So, could Bernanke be just fanning more investor's confidence by claiming his stance or is he really speaking the truth? Definitely, He cannot outright declare that the economy is heading for a double-dip recession! So, that is the question we have to think on.

My view is that we have to keep monitoring on whether is US economy actually recovering. Personally, I am not too worried since i believed that the economy that could come out and save the current crisis is China. China has been facing strong pressures to adjust their exchange rate to USD$.

Singapore's market follows closely to the Chinese economy as well and as such, if the stocks that we invest in have major business dealings in China, I believe that the stock is fundamentally strong against the current situation.

Above is the chart for a stock call: SIA engineering. I wanted to highlight this stock because of it's fundamentally strong foundation. Although i had not really done in-dept research as to how much exposure this company has in terms of the European and American continent.

But what i wanted to show here is more of a diagram or example of a fundamentally good stock.

I shall end this post with a declaration to the universe:

"I will stick to my investment PLAN and not fall in love with the investing vehicle, products or procedures!"

No comments:

Post a Comment